tv Markets Now FOX Business March 21, 2013 11:00am-1:00pm EDT

11:00 am

of payment funds. all of this, big negative for stocks. a shock all over the world. am i overstating my case, charles weschler mark. charles: absolutely not. stuart: love our viewers. i do not think it will ever happen here. >> is this a black swan event? will cyprus leave the union? will it matter? for every cyprus there is an ireland. for every spain, italy or greece, there is a --

11:01 am

stuart: take that money out of bank accountssincluding russian mob money or we will let you collapse. charles: somehow the beggars get to call. there has to be a line drawn. obviously, germany has an amazing argument. they have to put some skin in the game. you just wish it would come from somewhere else. stuart: they have drawn that line and it is midnight money. unless you take money out of bank accounts by then -- charles: there are no bailouts. there are no boundaries. >> that is a heck of a headline. stuart: a good headline. dagen and connell, it is now

11:02 am

yours. dagen: thank you, mr. varney. connell: thank you. i am connell mcshane. dagen: i am dagen mcdowell. trying to come to terms on keeping the government running. they want to get out of town. connell: one of berkshire hathaway's is here with us. dagen: twitter. seven years old today. happy birthday. connell: happy birthday, twitter. we have the money story behind the games and how it is torn apart. those stories and a whole lot more coming up on "markets now." ♪ dagen: it would also be one of the most famous racecar drivers birthdays of all time. it is top of the hour.

11:03 am

nicole petallides is on the floor of the new york stock exchange. nicole: i have to tell you, the markets are pulling back. we hit a record all-time high on the dow jones industrials. only to see us pulling back today once again. the dollar remained higher today. the nasdaq remains down .8%. the dow and s&p are down about .5%. yesterday, we saw a broad-based gains. most of the names were higher. today, we are seeing much of the same. it is the other way around. most of the dow components are lower. ibm, hewlett-packard, intel, a lot of the attack names are leading the way to the downside.

11:04 am

connell: going to breaking news out of washington with the house approving congressman paul ryan budget. cheryl: peter barnes is live from capitol hill with more. peter: the members of the house are now popping out of town like a pack of easter bunnies. they have approved paul ryan's budget that would balance over the next ten years. let's start with the continuing resolution to keep the government open for the rest of the year. it does not stop the sequester, but does give the pentagon the way to implement them. this would repeal obamacare to save about $1.5 trillion. it would budget additional spending cuts totaling about 5 trillion over ten years. this is just a blueprint.

11:05 am

it is dead on arrival over in the senate. now, the president will be releasing his budget sometime next month. two months late one republic leader noted in this air of arch madness. >> we still have no budget from the president in violation of the law. he gets his ncaa bracket in on time, but still no budget. this is the fourth time. >> it is founded on the failed idea that giving another round of tax cuts will somehow triple down and lift up all the other boats. we know that has not worked. peter: the senate starts its votes on its budget tomorrow. i will start here before i talk

11:06 am

about easter bunnies and march madness. connell: we do not want that, peter. we never want you to get into trouble. dagen: that does not get you into trouble with us. we go as far as talking about audio parts. right now we want to talk about funding the government. 68% of americans say it is a problem. connell: monica crowley is here with us today, as is leo kelly. interesting because of what we have seen in the stock market. today, with the market pulling back with all-time highs, it is not really about the stuff peter is reporting about. >> cyprus, his little country that no one really was paying attention to a couple weeks ago

11:07 am

certainly has no whole world turned upside down. what the market has really come to expect from washington is delayed until the last minute, but come up with a resolution. the threat goes away each time they do this. dagen: speaking of ignoring it, monica, though, you have reverted to as a debt crisis. they do not act like we are in a crisis. inflation is low, interest rates are also low if people are going about their daily lives. they may say one thing, but they are acting completely different. >> it does not affect their day-to-day lives, or so they think. the fox news poll you just cited with 68% saying this is an immediate debt crisis, this is not the only one saying this.

11:08 am

gallup, fox news, rasmussen, after the economy, the number two concern to the people is the debt. i think there is a growing sense that government spending and government debt at these levels, it does act as a huge drag on the economy. connell: what we have been saying here, unless the interest rates start to go up, you can pull people and they can say whatever they want. their behavior will not change unless you see a spike in interest rates. >> it will be hard to get a spike in interest rates with the fed flooding the system with liquidity. the whole world is on painkillers right now. we have become addicted to liquidity, easy solutions and until the fed start to bring it in and interest rates go up, i do not see a change.

11:09 am

dagen: do the people who are still buying taxable debt, you start to see money flowing back into u.s. stock. you see billions every week into world stock. >> i think we are somewhere close to the end of a bond bubble. for the third time in 60 years, we are looking at ten year treasury rates below inflation. that is, obviously, not a way to build over time. we have put $1 trillion into bonds from 2009-2012 and we are still not seeing it, now. this great return we are talking about, that has not happened.

11:10 am

connell: everything is reactive instead of proactive. if the bubble does burst, that is when they will act. >> most of the american people will feel it. the fed has pumped trillions of dollars down into the system. at some point, inflation will kick in. that affects everybody. when that kicks in, interest rates start going up. that is when you really have pressure come to bear on our politicians. dagen: i have said that for a long time. it could be a long time before that happens. good to see you both. welcome to the family, leo. >> it is a pleasure to be here. connell: on this day and our family, we wish happy birthday to our good friend twitter. twitter is seven years old today.

11:11 am

dagen is a big fan of twitter and twitter is a big fan of dagen. what was the big tweet seven years ago? it said "just setting up my twitter". dagen: very nice. we will check in the break. onto the latest with boeing. the company is planning to conduct two test flights of its revamped 787 with the new battery system. boeing received approval to begin tests on the new battery. boeing recently announced it was one third of the way through the test and expects to complete it in a week or so. connell: some very positive housing data. we will talk about that coming up this morning with one of berkshire hathaway's best in the real estate arena.

11:12 am

11:13 am

11:15 am

11:16 am

-- [ laughter ] charles: charlie is a little bit nervous about a pullback. connell: here we go. charles: cisco. not the cisco that most people think about. we have food outside. everywhere you go there is food. this company has been taking market share for years. they started in 1980. it is an absolute phenomenal company. on the earnings side, you know, the last two earnings, they missed the street. one of the stocks where they want to get into the market. connell: you want to have a conservative pick and you are

11:17 am

nervous. charles: a little bit of a pullback. by subscribers earn about 25% cash right now. the bears want to pullback and the bulls want to pullback because you can buy a stock a little bit cheaper. no real big numbers come out for a little while. this is a name that i think people are wondering, you know, i get e-mails all the time. some of the stocks people don't want to do because they are old. this, i think, is perfect for anyone. dagen: they advertise that by the way. charles: they are starting to advertise. it is a big-time company that is actually growing. it is not as awful as the other.

11:18 am

dagen: i can always tell if i am eating sycso stuff in a restaurant. if you order a margarita caught if they use sycso margarita mix, you can tell. not in a good way. [ laughter ] connell: stocks now and every 15 minutes. looking at oracle. nicole: i will just get right away from sycso are doritos right over to oracle. they came out with numbers after the bell late yesterday only to see it tumbling after the bell. revenue forecasts are below analyst estimates. software sales have been dropping and that is not good news for oracle.3 a couple of things to note is

11:19 am

that they downgraded oracle. wells fargo, bank of america and merrill lynch think it is a by opportunity. bank of america and merrill lynch oracle weakness is a buying opportunity. back to you. connell: thank you very much, nicole. the first man ever seven years ago, he has more than 2.2 million followers. dagen: i was close. bring it, people. more good news from the housing market. coming up, we have the ceo of dirk shirer hathaway. he will be talking all about it. connell: taking over the mobile industry. we will have that coming up a little later on from shibani joshi. first, let's take a look at

11:20 am

world currencies. let's see how everyone else is faring against the dollar. we will be right back with much more on "markets now." ♪ ♪ [ male announcer ] how could switchgrass in argentina, change engineering in dubai, aluminum production in south africa, and the aerospace industry in the u.s.? at t. rowe price, we understand the connections of a complex, global economy. it's just one reason over 75% of our mutual funds beat their 10-year lipper average. t. rowe price. invest with confidence. request a prospectus or summary prospectus with investment information, risks, feeand expenses to read and consider carefully before investing. >> announcer: you never know when, but thieves can steal your identity and turn your life

11:21 am

upside down. >> hi. >> hi. you know, i can save you 15% today if you open up a charge card account with us. >> you just read my mind. >> announcer: just oneittle piece of information and they can open bogus accounts, stealing your credit, your money and ruining your reputation. that's why you need lifelock to relentlessly protect what matters most... [beeping...] helping stop crooks before your identity is attacked. and now you can have the most comprehensive identity theft protection available today... lifelock ultimate. so for protection you just can't get anywhere else, get lifelock ultimate. >> i didn't know how serious identity theft was til i lost my credit and eventually i lost my home. >> announcer: credit monitoring is not enough, because it tells you after the fact, sometimes as much as 30 days later with lifelock, as soon as our network spots a threat to your identity, you'll get a proactive risk alert, protecting you before you become a victim. >> identity theft was a huge, ge problem for me and it's

11:22 am

gone away because of lifelock. >> announcer: while no one can stop all identity theft, if criminals do steal your information, lifelock will help fix it, with our $1 million service guarantee. don't waitntil you become the next victim. you have so much to protect and nothinto lose when you call lifelock now to get two full months of identity theft protection risk free. that's right, 60 days risk-free. use promo code: gethelp. if you're not completely satisfied, notify lifelock and you won't pay a cent. order now and also get this shredder to keep your documents out of the wrong hands-- a $29 dollar value, free. get protected now. call the number your screen or go to lifelock.com to try lifelock protection risk free for a full 60 days. use promo code: gethelp. plus get this document shredder free-- but only if you act right now. call the number on your screen now!

11:24 am

>> 21 minutes past the hour. hi, everyone. i am jamie colby. this is your fox news in it. the white house is considering shifting authority to the department of defense to allow more congressional oversight. critics complained the program lacks transparency. president obama urging palestinians and israelis to resume peace negotiations. president obama refused to endorse the call for a settlement freeze. the united nations will investigate charges that chemical weapons were used in syria. the syrian government requesting that probe accusing rubbles. the syrian opposition says the regime is responsible for the

11:25 am

chemical weapon attack. those are your latest headlines. i am jamie colby. i will send it back to dagen. dagen: hitting the highest level in over three years. mortgage rates are helping boost sales and prices. thankfully, inventory. it is part of burke shirer hathaway. a major real estate firm across this country. inventories have been so tight. how important is that to continuing to bring out the sellers? >> dagen, the biggest challenge that we have right now is the incredibly low inventory across the country. what a change it has been from two years ago when we were at an all-time high.

11:26 am

the sales activity is clearly being constrained by a lack of inventory coast to coast. dagen: i was talking about the jump in supply from january to february. it was a gain of roughly 10%. do you think that will continue. you will see more sellers willing to step up? >> yes, dagen. you know, last year we saw sales start to recover from the absolute bottom in 2011. last year we were up about 9% in sales activity and prices were about the same. this year we are seeing a continuation. sales activity is up about 10% from a year ago. i think we will continue to see a trend throughout the year that sales will be up about 10% on average from last year. i think pricing will be in the

11:27 am

high single digits. we have to keep in mind, we are coming off a very low bottom at 2011. this is very encouraging. i do not think we will get back to our normal numbers intel probably 2015. dagen: i made a comment earlier today about don't get into a bidding war and someone sent me a nasty e-mail telling me to put my dunce cap on. do you worry, are you seeing that or do you worry that somebody's markets like phoenix, for example, maybe getting a a little overheated at this point? >> clearly, what we are seeing is multiple offers on properties that, you know, the ink is barely dry on the listing. i do think what is putting a constrained to all of that is ultimately the appraisal. unless it is a cash offer with no conditions, not subject to an

11:28 am

appraisal or mortgage, cash is king. if you are getting a mortgage, it will ultimately have to appraise. we are seeing very conservative appraisals, and so that the prices will not skyrocket any time soon. dagen: that is incredible insight, ron. you always bring that. it was terrific to see you. be well. i know you are thankful that we have some sort of a hockey season. thank you very much. ron from home services of america. connell: you have to tell me when you get e-mails like this. dagen: i am always shocked that people would take the effort to send a really nasty e-mail at 7:30 a.m. in the morning.3 dagen: i would bet you $1000 --

11:29 am

connell: we will also talk about basketball. march badness getting underway. a very interesting business story as part of this. part of the excitement in the big east. they have become a victim of the game's success, in some ways. we have the conference commissioner coming up. dagen: bring it. the new money maker in technology is mobile payments. speaking of winners, take a look at some today on the s&p 500. ♪

11:30 am

but we can still help you see your big picture. with the fidely guided portfolio summary, you choose which accounts to track and use fidelity's analytics to spot trends, gain insights, and figure out what you want to do next. all in one place. i'm meredith stoddard and i helped create the fidelity guided portfolio summary. it's one more innovative reason serious investors are choosing fidelity. now get 0 free trades when you open an account.

11:32 am

♪ (train horn) vo: wherever our trains go, the economy comes to life. norfolk southern. one line, infinite possibilities. you are gonna need a wingman. and my cash back keeps the party going. but my airline miles take it worldwide. [ male announcer ] it shouldn't be this hard. with creditcards.com, it's easy to search hundreds of cards and apply online. creditcards.com.

11:33 am

connell: we're back on markets now. a lot of people talking about basketball today. a storied conference in the history of the college basketball completely reshaped and a lot of ways reshaped by money. that's why we're interested in it. we have the big east commissioner talking about the long run for the conference. that is just ahead. mobile pay attaching catching fire. investors report on that. lululemon dagen loves trying to get out of the news because of i guess defective yoga pants would be best way to put it if we're being polite. the earnings are out. we'll report on that coming up in up in a moment. dagen. dagen: see-through. i got to watch you on the giant monitor. your head is eight feet tall.

11:34 am

really scary. huge, huge, niggin. too bad it is not filled with, never mind. stocks now, nicole petallides live from the floor of the new york stock exchange. hey, nicole. >> hey, dagen. we'll look at too names on the move. we'll look at dow component hewlett-packard. we're seeing hewlett-packard on the move to the downside down about 2% but shareholders are obviously very displeased lately over the $11 billion british software acquisition autonomy. they wanted to raise the dividend. they got it. that comes to fruition, raise of dividend rates by 10%. they were cutting. been struggling with turn around slashing job, so they're continue to work on that, fixing that are performance, could take even more time than initially believed for jcpenney. suggesting any strategy any changes that that strategy

11:35 am

could be very costly and expensive. we'll continue to watch jcpenney. it is struggling and you know that. connell: nicole, thank you very much. just a few big years ago, big east conference had 11 teams in the ncaa. it even lost its name and now has 11 teams total. just an interesting story from a number of different per speck i was it. the tournament success going back years and years ago was built on some of the big east rivalrys. georgetown, syracuse. those teams are gone now. we have the current commissioner of the soon to be renamed big east. this is confusing for people. people are starting to associate the big east with the catholic schools and others that are leaving. you will have a new name right, is that the idea? >> connell, thanks for having me. we'll do it sooner than later because we realize we want to get rid of any confusion that might exist. connell: before i talk about the financials and everything involved, that is why we're interested in this,

11:36 am

what about the process what's in a name? how important is it? are you close? do you have any ideas? something with america? >> not sure it will be america but we're getting closer. there is a lot to a name obviously. it helps identify you. it brands you. it obviously has to lend itself to good artwork and logo and define who you are, what you are and what you want to be. it is very important. we thought a lot about it. we had deliberate and expeditious process going for and we'll finish up in the near future. connell: this is the new conference. most of us know the old big east. i was st. john fan and walter berry teams and the 84 final four with the big east teams. we know history of the big east. we know the -- there is the current big east. the big east is different and that will be a conference with a new name. are you disappointed with the way things panned out? now it is a mid major?

11:37 am

what do you think of the way the whole thing turned out for you? >> these have been challenging times. they have been difficult times. we've come through it very well. this is not a mid major as well. this is chance for football schools with basketball to become realigned. connell: you characterize the big east, the new conference. >> careful how i characterize it. we're the current big east. new conference soon. connell: you said this is major conference like the acc? it is a major college sports conference. >> we see ourselves. no reason we shouldn't. we have good football schools that will improve. we have big brand. we're in big cities. in major metropolitan areas. we have programs in florida that are enormous and doing very well. we have programs like cincinnati and uconn. connell: very good basketball programs. the economics of this. espn signed a deal worth seven years, $126 million. >> that is understated. we don't get into numbers but more than that we also have marketing rights which people have not really

11:38 am

focused on. we'll do a network deal and we'll announce that very soon for broadcast basketball. that will be part of our revenue as well. we've got other sources of revenue in our conference of the connell, we'll in good shape financially. the main deal is exposure. that will help the schools. that will mean a lot going forward. we all the names in the football nationally. a good majority of basketball will be nationally on major espn platforms. that is good exposure. connell: i know hindsight is 20/20, did you handle the tell voigs signing process and money the right way or no regrets. >> we rejected a deal that was bigger. we were in the midst of the negotiation with big 10 took rutgers and maryland. because it took maryland which lot of louisville to the acc that put a stop to the negotiations for a while. then the catholic schools decided they had been buffetted by the winds of realignment connell that affect, they're football-driven. they didn't want to be after

11:39 am

effected that way anymore. so consequently they decided to leave. but we managed to get the tv talks going again. it wasn't easy. there was a period of instability. but we did it and we're in a good place. connell: one of the good things, the football side of its is where the money supposedly is, individual teams in the conference, the schools, are any of these teams, i'm interested in this, are they individually profitable, their athletic departments, do they make money the teams in your conference? >> we don't get into that. they're all stable. connell: stable but not necessarily profit abable. tough business, people don't understand in some ways. they don't print money. it costs a lot to run a athletic department. >> it does. these schools do extremely well with the budgets. they're frugal and do a great job. connell: i'm interested in this. i could talk about it all day. how would you characterize college athletics, all the changes? good, bad, are you optimistic? >> connell, i'm optimistic. we have to do is make sure we preserve rivalrys. we reese is recollect some of the rivalries were lost

11:40 am

in this process. make sure that student athletes are front and center. the travel costs for kids. it has been a tough period. i think everything is stablizing. we hope is stays that way. you never know in this business. if it does we think our league has a very good future and we'll do well in football, basketball, olympic sports. connell: we have the current commissioner of the big east, soon to be renamed conference. good conversation. >> appreciate you having me. dagen: that was really great, a really great conversation. it is one of the fastest growing components in the technology area, mobile payments. investors are more than interested. good news, bad news for lululemon. the company beat the street with results but the yoga maker still forecasting a not so relaxing road ahead. all because of those see-through britches. we won't demonstrate. we don't have video unfortunately. we do have this. treasury yields to get you

11:41 am

excited. down on the ten year. ♪ [ male announcer ] this is karen and jeremiah. they don't know it yet, but they're gonna fall in love, get married, have a couple of kids, [ children laughing ] move to the country, and live a long, happy life together where they almost never fight about money. [ dog barks ] because right after they get married, they'll find some retirement people who are paid on salary, not commission. they'll get straightforward guidance and be able to focus on other things, like each other, which isn't rocket science. it's just common sense. from td amitrade. ...amelia... neil and buzz: for teaching us that you can't create t future... by clinging to the past. and with that: you're history.

11:42 am

instead of looking behind... delta is looking beyond. 80 thousand of us investing billions... in everything from the best experiences below... to the finest comforts above. we're not simply saluting history... we're making it. >> hi, everyone, i'm diane macedo with your fox business brief. stocks are modestly lower

11:43 am

despite better than expected reports on the u.s. economy. concern about the european debt crisis and slumming tech stocks are weighing on the markets and right now the dow is down about 29 points. lufthansa is grounding nearly 40% of the its flights after the union representing the airline's employees authorized a strike. the walkout started 4:00 a.m. local time. this comes as the next round of wage talks are scheduled for tomorrow. mcdonald's is making the chicken mcwrap a permanent part of its menu. the wrap will come in three varieties, chicken and bacon, chilly and ranch. and after they said they will offer a egg white version of the egg mcif you have minute. -- mcmuffin. that starts on april 20 2nd. that is the latest from the fox business network, giving you the power to prosper

11:44 am

11:45 am

ways and means committee would expand deductions for startup costs making permanent temporary rules that allow small businesses to expense purchases of equipment and property. and ease the burden of tax compliance by adjusting filing dates and letting businesses with $10 million in gross receipts use the cash method of accounting. what to make of, well the entire environment for growing a business in this country? ali wing, founder and ceo of giggle, the baby chain of stores and online sales. she joins us now. in terms of what you're seeing, just broadly, ali, the tax environment for you, it is getting worse, no? >> it is. i'm actually just in the middle of annual compensation reviews. i know every employee right now is feeling less in their take-home pay. that is a pressure of a different type for businesses. but it's the same old theme, whether it was not charging online only businesses sales tax or people off-line had to have it. just needing to even the

11:46 am

playing field. not a disinincident tiff to big next generation of big businesses in america and right now it is still uneven. dagen: we talked about though the complications created by government, local government, state governments, the federal government in running a business today. we're celebrating the anniversary of the health care law and, what we've seen washington do in recent years. is it getting worse to grow a business in this country? are you seeing any easing in sight? >> i think everything ebbs and flows. so i'm always a optimist. >> i'm an entrepreneur. dagen: you sell baby stuff. you're in the baby business. >> but the layers are complex. so i'm a big advocate of simplification and competitive playing field. i also think that we have a lot vested in still simplifying and removing barriers for businesses to keep making america the place of innovation. you know, there is no big business out there that it was, at one point wasn't a

11:47 am

small business. what we do have is so many layers, just the efficiency of managing even compliance is disproportionately expensive, the smaller the business is. dagen: how is business? >> it's good. we're actually, one of the things i can say that is positive in the tax change, i can't, it is not coming from washington but i will say the states. we are seeing in our business a multichannel retail business, the positive effect of evening the playing field in taxes of online players with versus small size channel. we're starting to see it. we're starting to see it. we actually really feel the momentum this year and we're excited about that. from a giggle per speck stiff we're super excited about our big expansion with jcpenney. dagen: even with jcpenney's problems? >> we're actually super excited. dagen: they need you more than you need them maybe. >> we always said it is complex to do what they're doing but none of what he ising try to do is in the stores yet. and what i know is what is going to be in the store in the fall because giggle baby

11:48 am

is all done for next fall. dagen: okay. >> and it's fabulous and it is coming this summer in 500 stores nationwide. dagen: congratulations. >> thank you. dagen: always optimistic, ali. founder of giggle. i love of the name. connell: we love giggle. let's go back to nicole for another look at the markets. dagen: makes me want to tickle you. connell: i don't think so. what do you have for us? >> let's look at some interesting news here that's been breaking over the last half hour or so. we're looking at bmc. bmc software was halted here at the stock exchange. it hit the circuit breakers. you can take a look now. it reopened. it has a pop. that is two-day chart. you can see yesterday looks like steady-eddie and soars on the news here. reuters actually wrote up that there was talks that the company could be taken private for $6 billion, near the market cap of $6.29 billion. there appear to be two consortia participating in the auction one by kkr and

11:49 am

tbg capital and bain capital and golden gate capital. we'll continue to follow the story but obviously pushing the stock up. back to you. connell: all right, nicole. dagen: lulu's pants problems. ali wing and i were actually talking about it during the break. you know what? it is just a funny story. it impacted the companies outlook. they reported earnings. we'll get into numbers for you. connell: the numbers behind the situation this week. also the nasdaq winners today, well, not as easy to pick out with the market pulling back although worth pointing off out we're off earlier lows. we'll be back with more "markets now". five seconds. three, two, one.

11:50 am

standing by for capture. the most innovative software on the planet... dragon is captured. is connecting today's leading companies to places beyond it. siemens. answers. but that doesn't mean i don't want to make money.stor. i love making money. i try to be smart with my investments. i also try to keep my costs down. what's your plan? ishares. low cost and tax efficient. find out why nine out of ten large professional investors choose ishares for their etfs. ishares by blackrock. call 1-800-ishares for a prospectus which includes investment objectives, risks, charges and expenses. read and consider it carefully before investing. risk includes possible loss of principal.

11:53 am

some estimating it to in fact be 171 colorado billion industry. dagen: shibani joshi is live from the innovation project in cambridge, massachusetts with a venture capitalist who is investing in this space. shibani? >> hi, there, dagen. yeah, we're at the innovation project here on the harvard campus. they're coming up with all sorts of ideas to lighten your wallet. so cash, gone. your department store credit card? they want that gone too. your movie rewards card? they want that gone. and your starbucks or any sort of gift card? they want to lighten your load all together. one company that is investing this space is bain capital. they have a new venture capital fund and bret harris is joining me now to talk about everything going on at the innovation project. thanks for being here, matt. let me start off asking you a very simple question. what is the problem with cash and credit cards because i seem to be fine managing mine. >> one of the issues with adoption not hard to swipe a

11:54 am

card. the real pain point is with the merchants who are tired of anonymous transactions like cash and credit cards. they want to know more about the customers. they want to communicate with the customers. they want you to have your smartphone with you so they can message you. consumers not so. >> money like yours, like bain capital coming to so solve a problem and make money. what is the big money opportunity for businesses because that's where you say you're focusing your investments? >> we think the near term opportunity to b2b payments. it is $3 trillion market in the united states. business still paying each other and 70% paper check. very expensive. $15 to prepare and send a check and $5 to receive a process it. that is huge pain point that is a problem now and we think businesses will make logical decisions how to change their behavior. >> that is pretty profound. small businesses cost $20 per check to send and receive. what mobile payments will do is eliminate all together but another big problem here

11:55 am

in the industry is regulation. how are you managing that as you're coming up with ideas how to invest and who to invest with when the situation is so murky? >> right. the single biggest problem in payment regulation the states play an enormous role. frankly we could deal with almost any regulation if it were consistent in federal but dealing with 50 states with their own rules, very problematic. we have a very active cfpb. they have come to visit me three times. they're looking to talk to innovators and investors and i think they're being sensitive about it but it creates uncertainty. the more certainty the better for investors. >> before i let you go, matt, how soon do you think this will be reality where businesses and consumers get rid of car and cash and pay with their phones and paying electronically? is it five years away? is it sooner? >> i've been saying five years. one wildcard is apple. apple controls their whole ecosystem. if they decide i had to make a push into payments and allow you to take itunes account and restore credit

11:56 am

card, pay with iphone. things could move more quickly. >> they just unveiled that passbook, right? not that long ago. they're thinking about it. >> they're making moves. >> they're making moves. they will change everything. matt harris with bain capital. we'll be here at innovation project all throughout the day. we'll talk to small companies. we'll be talking to big companies and telling you how soon to start use smartphone everywhere you go. no more standing in line and cash registers. it is not a thing of sci-fi it will happen and tell you how soon you will all will be doing as well throughout the day. stay tuned on fox business. back to you guys. dagen: thank you, shibani. connell: we'll talk about lululemon coming up and not just see-through pants. dagen: that's all we're talking about. connell: the numbers behind the whole thing so to speak. out with fourth quarter results and well, we'll see about the forecast going into the future and how this whole issue this week is affected things. dagen: sandra smith has numbers in today's trade. >> as it turns out

11:57 am

see-through pants will cut into first-quarter earnings. company in earnings announcement today, they are actually forecasting 28 to 30 cents a share for the current quarter. that would be down from 32 cents in the same quarter last year. so they are expecting it to put a dent into its earnings. look at the stock here, getting a nice boost today. this is stock that definitely needs down about 7% over the past week, as all of this news unfolded that it was pulling these pants from its store shelves. it affected 17% of its overall pants in supply at that moment. for the month the stock is down. year it is down 15%. it does not come at a good time. doesn't take away from the fact that lululemon reported spectacular earnings. earnings 75 cents a share up from 51 cents a year ago. revenue numbers up 31%. same-store sales numbers up 10%. for that reason stifel

11:58 am

nicolaus came out and said put a buy rating on stock and lowering price target. shares are 75 bucks a little lower than original forecast of 83. dagen and connell, while the forecasts are sort of dim as far as pants sales, analysts are still optimistic. back to you. >> very good news. thank you, sandra smith in the newsroom. dagen: i want to know how they disevered -- discovered they were see-through? honey i can see your buttocks through the pants. connell: i love it when you do that. dagen: california taxing problem. cheryl casone with part four of her week-long series. >> congressman john garamendi how to keep people from fleeing high taxes in the golden state out in california. tax paying on "markets now." keep it here.

11:59 am

12:00 pm

15% today if you open up a charge card account with us. >> you just read my mind. >> announcer: just one little piece of information and they can open bogus accounts, stealing your credit, your money and ruining your reputation. that's why you need lifelock to relentlessly protect what matters most... [beeping...] helping stop crooks before your identity is attacked. and now you can have the most comprehensive identity theft protection available today... lifelock ultimate. so for protection you just can't get anywhere else, get lifelock ultimate. >> i didn't know how serious identity theft was until i lost my credit and eventually i lost my home. >> announcer: credit monitoring is not enough, because it tells you after the fact, sometimes as much as 30 days later. wi lifelock, as soon as our network spots a threat to your identity, you'll get a proactive risk alert, protecting you before you become a victim. >> identity theft was a huge, huge problem for me and it's gone away because of lifelock. >> announcer: while no one can

12:01 pm

stop all identity theft, if criminals do steal your information, lifelock will help fix it, with our $1 milon service guarantee. don't wait until you become the next victim. you have so much to protect and nothing to lose when you call lifelock now to get two full months of identity theft protection risk free. that's right, 60 days risk-free. use promo code: gethelp. if you're not completely satisfied, notify lifelock and you won't pay a cent. order now and also get this shredder to keep your documents out of the wrong hands-- a $29 dollar value, free. get protected now. call the number on your screen or go to lifelock.com to try lifelock protection risk free for a full 60 days. use promo code: gethelp. plus get this document shredder free-- but only if you act right now. call the number on yr screen now! if

12:02 pm

cheryl: coming up fast and furious on noon eastern time on "markets now." hello, i am cheryl casone at the dow bouncing back a little bit midday despite issues in cyprus and here at home. the banking crisis on the tiny island and pressure on the tech sector pushing markets lower this morning. we have a debate coming up with our bare saying the market has risen for the year. in the housing market continues to charge ahead. home inventories at the lowest levels in 14 years. increasing home sales at a three-year high. a closer look at the next generation of home buyers. and california's taxing problem. part four of our weeklong series. congressman john garamendi joining me on how to keep people from fleeing the high taxes in the golden state.

12:03 pm

powers ahead. stocks every 15 minutes am a nicole petallides on the new york stock exchange. cheryl: i was just glancing up to see where we are because we continue to get headlines from abroad. down one quarter of 1%, if it be much of the same and the nasdaq is the worst of the bunch down 0.6%. lots of the dow components that are tech related are the biggest losers on the dow. that is certainly weighing on it. this has been a big name we're following, down eight and a quarter percent, came up with numbers disappointment for the earnings per share, revenue and the outlook and sales they have been experiencing, so this one is a loser today yet some of the analysts say it is a big buying opportunity. so we will see. cheryl: nicole, thank you very

12:04 pm

much. we will see how the market does. stocks down this morning but coming back a little bit off of session lows right now. now, we got a big intraday high for the dow. the s&p almost hitting a new all-time high, one point away. charlie, i want to start with you because you said yes and he isn't going to go much further from here. i know you have a different take on all of this, but why are you so bearish on all of these numbers? >> we are not particularly bearish, but we think they will matter much more than the dividend for the rest of the year. you put a 15 multiple on that, you're about where we are right now. revenue growth will be really problematic for this year. oracle and caterpillar and

12:05 pm

fedex, it'll be tough to come by for this year. cheryl: do you agree with that? focusing on the earnings growth that there is a case the there? >> i don't think so. is therexcited just below doublt earnings this year. i think the economic data came better in the consumer is a little bit frisky. i have seen their net worth go up and income up a little. i think that is it a catalyst for the market to go higher. it is easy to make a bear case, but the market goes down 5% three times per year, so he could have a selloff, but the market will close the s&p

12:06 pm

>> the market is cheap, and if you look at the large cap stocks relative to smal small-cap, 20 % disparity there. the multiple can expand. the long-term average for the s&p stock market pe ratio is 60, right now we are at 14. that is going to definitely increase the confidence of investors and push the market higher. cheryl: i know you are bearish and you say we will be staying in that simple range. teddy mentioned the housing market, we got incredible data on the housing market, we will get into that in the next segment but the housing recovery seems to be look at the

12:07 pm

homebuilders, these are strong earnings that are being powered ahead by the fact people are buying homes. wouldn't that be a market bull in your opinion? >> it does also the case for u.s. consumers. i'm a little concerned a lot of the growth in home prices over the past year has been driven by hedge funds and cash buyers. i'm not sure how sustainable that is, the mortgage market is going nowhere. i don't think we can have a truly healthy housing market until he gets to trade up market going. there is really no sign of that. we think that'll be a problem for the economy and the market. cheryl: one of the pieces we are seeing today, taking a close look at apple right now, you

12:08 pm

think is going to grow, what kind of targets do you have on apple? >> i can see apple going up to 600 over the next year. what has happened to apples with everybody expected. a little too big, little too fast. they became a target similar to how microsoft was a target a few years ago. product cycle still strong, stocks are really cheap, everybody is bearish on apple by think the stock will provably wrong this year. you can see it going comfortably into the mid-five hundreds this year. cheryl: used a sandisk is a stock in your portfolio right now. >> is a better way to play growth than apple. the capacity growth in flash memory has stopped and you look at the seasonal history of flash pricing it falls between christmas and the end of the first quarter. this year flash memory prices

12:09 pm

have increased more than 10%, so that is a real anomaly. ripping earnings for sandisk will push up close to 50% this year, burning north of $4 in the earnings estimates still 10% below that, so we think that is a real opportunity. cheryl: you like ge. i'm really curious about your banking pick. the stress test was not really friendly, why do you like them? >> they are in an area of the country that continues to grow, the south. we were decimated by real estate. their portfolio is getting better. the company will still grow pretty fast. at some point they'll be able to grow the dividend the way they would like and one of those companies potentially could be a takeover target.

12:10 pm

cheryl: a takeover target, there you go. we will have to follow up on that in the next segment of the show. charlie smith, great to have you both back again. >> thank you for having us. cheryl: we were talking about housing with charlie and teddy. high demand, low inventory. a three-year high, prices rising 11.5% year over year. analyst: it's a full-blown housing recovery. joining me now, i'm sure you were not surprised by the data we got this morning. >> we were not surprised, but we are very, very heavy obviously with the numbers. we're off to a really strong spring selling market and that is what we hoped for. cheryl: average median home price across the country, so the national average, but do you

12:11 pm

think we will see prices continue to skyrocket higher given we have incredibly low interest rates and inventory? >> the inventory went up slightly january versus february. so it went up from 4.3% to 4.7, not a huge jump but significant enough to give us some positive signals. cheryl: we are seeing first-time homebuyers, stressed sales, the generation y., first-time homebuyers. you just did a survey to show they are buying fixer-upper's which is different from my generation. >> and different from my generation which was the mansion scenario. what we are seeing out there, let me take a step back and talk about 100 million graco boomers that will be driving the market the next 30 years.

12:12 pm

in a recent survey we did, 30% said they would buy a home within the next three to five years. we took a deep dive into their psyche to see what they wanted and what they told us were several things, number one wanted smart homes, number two they wanted a small home, they wanted a custom home built for their needs. cheryl: 84% think technology has got to be a piece of their home. that has something that has evolved. >> absolutely. they want to be able to raise the heat with their iphone, turn theelights on and off. even saying like i don't want a dining room anymore, i want a home office, a media room, they are changing significantly. cheryl: i wonder if the homebuilders know this. these are the homebuilders that have powered the market, stocks

12:13 pm

that have been taking off. do you think the homebuilders in that cycle know this, can they compete in the generation y. category? >> i believe they do know what, they do their own surveys, and that is going to tell them a lot. if we go back to the fixer-upper's, this young generation is interested in buying a home that needs some work and customizing it themselves. so there is a growing amount of inventory coming on the market that will allow them to do this. cheryl: i am sure the builders will put those incentives out there to get the young person in, but the young person is going for the fixer-uppers, going for the technology. we will be watching apple stock as well as the builders. thank you very much. good to talk real estate with you. >> always. thank you. cheryl: shoe giant nike's

12:14 pm

earnings will be coming out after the bell. sandra smith will be joining me on if you should be jumping into this stock now. and it is all about on this, being chime james bond. we will tell you how you can do this, but it will cost you and it will cost you big. plus, california taxing problem, congressman john garamendi on how to keep businesses and high net worth individuals from fleeing the high tax environment, the golden state. coming up. clients are always learning more

12:15 pm

to make their money do more. (ann) to help me plan my next move, i take scottrade's free, in-branch senars... plus, their live webinars. i use daily market commentary to improve my straty. and my local scottrade oice guides my learning every step of the way. because they know i don't trade like everybody. i trade like me. i'm with scottrade. (announcer) scottrade... ranked "highest in customer loyalty for brokerage and investment companies."

12:16 pm

12:17 pm

12:18 pm

phil flynn at the see me watching the gold contract. sandra is watching nike getting her running shoes on. charles payne showing us how to make money on drugs. first, nicole at the new york stock exchange. nicole: take a look at the major market averages, dow jones industrials down after hitting an all-time high intraday yesterday. the s&p 500 not far off their highs as well. look at the major averages across the board, the nasdaq is the worst of the bunch. cisco systems a big loser on the dow jones industrial average. they downgraded to underperform. lots of tech coming under pressure. oracle a big loser after the quarterly report. cisco, ibm, hewlett-packard among the wee week names. the fear index to the upside, one after another, a way to save

12:19 pm

cyprus and make it through on the bailout, but right now that his latest on the floor of the new york stock exchange in new york. what is going on in chicago, phil flynn? phil: gold right now is back. everybody was writing off the yellow metal a couple of weeks ago. not so much anymore. take a look at gold, a six-week high, the highest since february. concerns about cyprus, north korea, the euro and the problems of cyprus definitely in play here today. when you look at the gold market right now, it looks like it is breaking out to the upside once again and dragging the other precious metals with it. we have seen silver starts to rise, the other side of the coin are the industrial metals struggling right now despite seeing the strong dollar and the weaker euro because there is concern the cyprus situation could slow the global economy. add to that weak economic data

12:20 pm

from europe making that situation a lot worse. now take a look at what sanders looking at at the wizard. sandra: i do not have my running shoes on right now, cheryl, but i am rocking the new nike sneakers. heading into this earnings after the bell, stocks down about 1.5% if i bring up the one-week chart, stocks down 2%. there is a lot of negative sentiment. after the bell earnings of $0.67 per share expected by analysts on $6.2 billion in revenue for nike and nike set the tone as far as money that people are willing to spend. it gives us an idea of how the consumer is spending. for the month, it is still down 1%. however, it is still for the year holding onto a slight gain. charles, this is for you.

12:21 pm

4%. to the upside, largely underperforming the broader market, the s&p 500 and the dow looking for possibly a surprise after the bell tonight, stocks down 1.5%. the average analyst rating on the stock right now overweight rating $58 price target. there is optimism and the stock is down. cheryl: nike is a great stock and i think you do have your running shoes somewhere because you are standing in 4-inch heels while pregnant. thank you very much. time to make money with charles payne and his looking at drug stocks overall. charles: it is sort of defensive. i was in nike town on sunday, it was packed, absolutely packed. what i find interesting is people should know the major

12:22 pm

product, babies, one of the reason i've been excited about the market for a while has been the global economy and when we talk global economy we talked europe, japan and america. there'there is more to the globl economy than that and that is when the market is just fine. look at the top 10 markets. number one china. sales havthe sales have doublede last three years. doubled in the last three years. number three is mexico, thailand, vietnam, brazil, peru. the number-one or number to two every single one of those markets to talk about the global economy we rarely talk about mexico's economy. i had lunch with somebody yesterday from malaysia, i think these guys will enjoy enormous growth. 10% in latin america and asia. the birth rates are down, but this is a stock acting pretty good.

12:23 pm

i think it is a value play. huge spike in volume. dividends have gone up every year. they are paying dividends and executing. cheryl: when you look at a stock like mead johnson, your overall bullish on the stock sector. >charles: particularly this one. i think it is a $90 stock or more. cheryl: charles payne, thank you very much. it is the fastest-growing component in the tech sector. mobile payments. how you can make some real money coming up. and "tax pain." congressman john garamendi and how to keep people from fleeing high taxes in his state, the golden state. part four of our series is ahead.

12:27 pm

12:28 pm

stopping the shutdown until at least september 30. the bill will go to the president to be signed into law. president obama urging palestinians and israelis resume their peace negotiations while meeting with palestinian president, president obama refused to endorse because t thy and call for settlement freeze. houston is one to stop israeli housing on the stake as a condition for restarting the peace talks. in warning islamic republic will destroy the cities of tel aviv if they are attacked. israel threatened action against iran if it continues its nuclear development activities. they said iran has a national right to enrich uranium. those are your latest headlines. back to cheryl. cheryl: thank you very much. we're going to take a look at the market, we have had a lot of interesting action over the last three trading sessions in particular as we sit here today and look at the dow and the nasdaq and s&p.

12:29 pm

first, yesterday the intraday high of 14586. we have had an incredible amount of jubilant in the market particularly for the new highs we have been setting day after day. intraday high yesterday not a new record close last night, but again the dow with towering higher. look at the s&p, what we have had in the final hour of trading yesterday was the s&p. here are the builders, look at the builders right now because the builders are a big piece of the puzzle. all the names are lower except kb home. this is despite the fact you have existing home sales, this could be a piece of the story for homebuilders, existing home sales touching a high. 15% are the homebuilders, so there is pressure coming in today. watching the numbers coming in on "markets now" going through the last four hours.

12:30 pm

well, it is an industry that has grown. over 60% in one year with the estimated 212 million users in 2012. mobile payment sector has grown. shibani joshi is live from the innovation department in massachusetts with the leader in the credit card space. >> hi, cheryl. last hour i threw out my credit cards and cash. maybe i was premature on that because it is not just the venture capitalists that are here at harvard university, it is also the big credit card companies including discover financial. joining me now, diane, the president of discover payment services. it is great to see you here today. i am surprised you are here because it seems at least in theory the whole concept of mobile money is bad for your business as a credit card and

12:31 pm

financial institution. >> i think that is a big understanding that it would be bad for our business. discover has always been a company that prides itself in innovation. all this talk about mobile, maybe the ss device changes but the thing t things you love abot discover today using it, getting your cashback bonus you may do with your mobile phone but all the other things that make discover will always be there. >> walked me through an example for the viewers so they understand what is going on. they're walking into nordstrom's and buying a pair of shoes, how are you looking to change the way they pay? >> imagine sitting down trying a pair of shoes, you like them and all of a sudden you ask the clerk i would like to comparison shop. mobile is going to change not witthatwith a transaction paymet happens, but it will change the experience around making the purchase. >> so you will be able to use paypal and other services or

12:32 pm

even a discover card but not necessarily use the card. >> not the form factor. in time you will see it integrated into your mobile phone. >> visa said they will not impose these on digital wallets. what is your stance on this fee in position? that is if they wear how going to make money. >> they already have a way to make money. they want to partner with paypal, not to tax them. having a partner with us moving them into our world so you can use your paypal account shows we're going to partner rather than add a feed or make it part of it competes in the new world. >> it is not just paypal discover what to partner up with, they want to be everywhere you are making transactions and transferring money. look for discover everywhere.

12:33 pm

it is all about making money in a mobile way, and we're talking about it here at the innovation center. cheryl: coming up in the next hour, shibani joshi will be with a gaming sites taking on companies like discover. also, if 1:00 p.m. continuing resolution or continuing dysfunction. lou dobbs joins melissa and lori on the stopgap effort to keep the government funded. coming up, how about taking an aston martin around for a little spin, just a casual date in your aston martin. and "tax pain." part four of our weeklong series, congressman john garamendi on how to keep people. this is a problem in this state. how to keep people from fleeing california.

12:34 pm

oh this is lame, investors could lose tens of thousands of dollars on their 401(k) thidden es. is that what you're looking for, like a hidden fee in your giant mom bag? maybe i have them... oh that's right i don't because i rolled my account over to e-trade where... woah. okay... they don't have hidden fees... hey fern. the junkrawer? why would they... s that my gerbil? you said he moved to a tiny farm. that's it, i'm running away. no, no you can't come! [ male announcer ] e-trade. less for us. more for you. all stations come over to mithis is for real this time. step seven pnt two one two. rify and lock. command is locked.

12:35 pm

five seconds. three, two, one. standing by for capture. the most innovative software on the planet... dragon is captured. is connecting today's leading mpanies to places beyond it. siemens. answers. ♪ (train horn) vo: wherever our trains go, e economy comes to life. norfolk southern. one line, infinite possibilities.

12:36 pm

now over to you charles???? sir charles' single miles card left him blacked out. he's coming to us from home. that's gotta be traveling. now instead of covering the final four, he's stuck covering fourth graders. brick! bobby is 1 for 36. mikey? he keeps taking these low-percentage shots. and julio? i don't know what julio's doing. next time get the capital one venture card and fly any airline any time. what'sn your wallet? can you get me mr. baldwin's autograph? get lost, kid.

12:37 pm

cheryl: time for stocks now with nicole petallides on the floor of the new york stock exchange. nicole. nicole: how much time is it really going to take to fix jcpenney? that is the question shareholders, investors, wall street communities want to know. here's what we're looking at right now, jcpenney down 4% right now. jcpenney said fixing their performance could take more time than they initially thought. of course they have worked on their strategy.

12:38 pm

ron johnson from apple came over to save jcpenney, didn't do so, on the contrary the kuwaiti promotions, didn't get that going for them so they say now any turnaround plan that he will be more expensive than they originally thought. so it will take longer and be more expensive after the stock is down 56% in the last year. back to you. cheryl: nicole, thank you. "tax pain," our series continues. california's losing residents and businesses because of the state's high taxes. but how will other states like texas able to keep taxes so low? speaker we had a balanced budget amendment, we cannot spend more than we take in. we're also very fiscally conservative state. we simply don't spend beyond our

12:39 pm

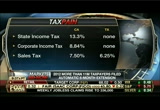

means. cheryl: so what does the golden state two to compete? congressman john garamendi joins me from capitol hill. i know you have had a busy morning that it is good to see you, thank you for joining us on this topic. >> always good to be with you. cheryl: we were looking at the differences between texas and california. governor rick perry go after small businesses in your state and big as mrs. to get them to come to texas. here are the numbers, i want to get your reaction to this. 13.3% state income tax, texas is zero. corporate income tax 8.84% in california. texas is zero. is your state willing to address these tax rates to keep businesses in california? >> actually california is losing very few businesses to any other state. governor perry came out to

12:40 pm

california and went back empty-handed. there is a lot of reasons why businesses want to be in california. you just had that clip on the convention going on in boston. many of those companies at that convention are in fact california company startups and the like. the underlining foundation of infrastructure, education, the existing businesses that are in california. all of that provides a solid foundation for economic growth and for businesses to stay in california. some leave, but actually over the last decade and a half, it has been very small percentages of the total employment in california, actually less than 1% of the total employment has left. there has been a decline, but that is from the general collapse of the economy causing a crisis in the economy. the real key to success is

12:41 pm

education, research, infrastructure, manufacturing of all kinds of things and change. cheryl: i am glad you're bringing up the answers because that is what i wanted to hear from you, what can i do to keep companies like apple and facebook. these are companies that are still headquartered in california but expanding in the state of texas. one thing we look at was the cost of doing business, to look at the national average, texas is well below the national average when it comes to doing business, cost o the cost of bus below 4.6%. california is above the national average, so if you add up everything together, you are a small businessman, that is why these companies are telling us it makes more sense to be in states like texas and even florida. >> it depends on what part of the business is moving. clearly some parts of the california business have moved

12:42 pm

on, some manufacturing, low-tech manufacturing, those have moved on. what we built in california is a high wage economy dependent upon those things i described to you. our higher education system is the best in the world. if you look at the infrastructure, it is pretty good. it is extremely important for all kinds of businesses, agriculture and the tech business. and then we have the research, but we have the best research anywhere in the world, so you put those up against the taxes, yes, the taxes are an issue, and there are better ways to deal with the taxes. but we are now in a situation where we have nearly a balanced budget and we will go forward, we will spend the money on the

12:43 pm

things to create economic growth and we are competitive. we are competitive in the things many businesses need which is that infrastructure. the other things beyond just the cost of doing business. cheryl: i lived in san francisco for seven years, you don't have to sell me on the beauty of california. congressman john garamendi, thank you. good to see you. >> thank you. bye-bye. cheryl: does the u.s. economy need higher taxes? our guest will weigh in, he's very opinionated on the topic. and we will wrap up with an expert panel to answer your tax questions. we are doing that tomorrow as well. i don't know about you, but i have always wanted to drive an aston martin.

12:44 pm

how you can take one for a spin around the race track. i guess i am driving one now. i will take it, i will take it. take a look at the 10-year treasury. why is my head sticking out of the car? [ male announcer ] this is joe woods' first day of work. and his new boss told him two things -- cook what you love, ansave your money. joe doesn't know it yet, but he'll work his way up from busser to waiter to chef bere opening a restaurant specializing in fish and game from the great northwest. he'll start investing early, he'll find se good people to help guide him, and he'll set money aside from his first day of work to his last, which isn't rocket science. it's just common sense. from td ameritrade. ...amelia... neil and buzz: for teaching us that you can't create the future... by clinging to the past.

12:45 pm

d with that: you're history. instead of looking behind..... delta is looking beyond. 80 thousand of us investing billions... in everything from the best experiences below... to the finest comforts above. we're not simply saluting history... we're making it. a talking car. but i'll tell you what impresses me. a talking train. this ge locomotive can tell you exactly where it is, what it's's carrying, while using less fuel. delivering whatever theorld needs, when it needs it. ♪ after all, what's the point of talking if you don't have something important to say? ♪

12:46 pm

>> i'm tracy byrnes with your fox business brief. mortgage rates drop ahead of the spring home buying season. the average rate on a 30-year fixed mortgage is now 3.54%. the rate has been below 4% for a full year. it is helping to fuel housing demands. and big oil companies are pointing fingers. the federal renewable fuel standard driving up gas prices and they want the mandate repealed. oil companies are just worried about demand dropping off. a new survey shows 28% of american companies can't fill job positions. a lack of qualified candidates. the harder jobs to fill come information technology, engineering and creative design. that is the latest from the fox business network giving you the power to prosper.

12:48 pm

cheryl: a quarter until come every 15 minutes, stocks now with nicole. deep in the red today. nicole: let's take a look at the stock. hitting a new 52 week low as you can see on a one-year chart. they have put the largest subsidiary into bankruptcy and as result this is why you're seeing this move. the 10-year chart, you saw the spike, and since then has been going on. there have been declining prices for solar panel products, global trade occurring in all of this weighs on this particular company, that is why you are seeing part of it going into bankruptcy. listed on the stock exchange in

12:49 pm

new york will not file for bankruptcy, but this is moving on the news of the subsidiary. back to you. cheryl: nicole, thank you very much. on the road and into the fast lane. if you've ever dreamed of getting behind the wheel of an aston martin and hitting the racetrack may want to head to my next guests team. you have to businesses. raising, aston martin and wine and you combine them sometimes. tell us how we can get involved. >> it has a really cool dynamic. we have seen this amazing amount of relationship marketing people have been doing and corporations with very high levels, finding new ways to link themselves to their customers. motorsports has been a secret weapon for us. after 20 years of working hard with the racers group, i took

12:50 pm

over as the ceo of the component in the united states. we're bringing it to the market at a lot of different levels. cheryl: you have the racing te team, and opening up to those who can afford and want to drive an aston martin on a professional speed's track. i want to go, what is it going to cost? >> there are many levels. multimillion dollars program, but the entry-level program we have the advantage, it is paddle shifter, traction control, you can drive it today around the track under $200,000. cheryl: you have major corporations. i assume you're spending more

12:51 pm

money, coming in with companies. >> this program can be for individual who wants to hit the track or just have some fun. we will rent four, five, six of these cars for a weekend to come in and have a driving day. all around motorsports with the wind. cheryl: you also have the wine business on the side. it is a small sonoma production. you said you had an amazing amount of orders for this wine. >> it takes 15 years to be an overnight sensation in the wine world. we do a lot of fun events, we do wine events. i did about 50 last year, it is great.

12:52 pm

cheryl: i will not be drinking and driving the car. you are doing a double marketing with this. it is a very interesting business, we will have to take a field trip for fox news. see you there. thank you very much. dreams finally come true. ending the dreamliner nightmare. boeing conducting test flights on the 787 battery system. coming up in my west coast minute. and a look at the nasdaq. 7% for the year, a look at some of the numbers. [ male announr ] you are a business pro.

12:53 pm

omnipotent of opportunity. you know how to mix business... with business. and you...rent from national. because only national lets you choose any car in the aisle. and go. you can even take a full-size or above. and still pay the mid-size price. i could get used to this. [ male annocer ] yes, you could business pro. yes, you could. go national. go like a pro. [ male announcer ] how could switchgrass in argentina, change engineering in dubai, aluminum production in south africa, and the aerospace industry in the u.s.? at t. rowe pric we understand the connections of a complex, global economy. it's just one reason over 75% of our mutual funds beat their 10-yealipper average. t. rowe price. invest with confidence. request a prospectus or summary prospectus with invtment information, risks, fees and expenses to read and consider carefully before investing.

12:56 pm

cheryl: time for your wes your t coast minute." seattle-based boeing looking to begin test flights of the 787 dreamliner to see how the battery will perform. according to reports flights could begin this week but boeing refused to comment. take a look at the stock comic has been a story stock for the year. right now it is down. the california citizens compensation commission is currently reviewing how much state lawmakers should be paid. they had been full of appointees like governor schwarzenegger, but now governor brown filled the group with his own choices. what is unclear is if the commission is going to leave the current salary structure alone or if they will vote to give themselves all races. and that is your "west coast

12:57 pm

minute." another landmark for you to become a popular video sharing site has more than a billion people on youtube each month which means the world has been busy watching cute babies and animal videos. cat videos actually just to be clear. the most popular video, here it is, "gangnam style." youtube reached the billion per month milestone five months after facebook did. google owns youtube. $813 per share. down $0.93. keep the music going. tomorrow our "tax pain" series continues. thus u.s. economy need higher taxes? grover norquist will be here to weigh in. he always has something to say. and then we will wrap it up with an expert panel.

12:58 pm

tweet them. we will be answering your specific questions tomorrow, that is small business, that is personal, anything you need to know, we will help you out tomorrow. dow down 45 points right now. it has been up and tak day for . the reasoning and investment strategy to prosper will be coming up. and also there is this. lou dobbs on washington permanent band-aid approach to funding the government. melissa francis and lori rothman coming up as "markets now" continues.

139 Views

IN COLLECTIONS

FOX Business Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11